A will is just a click away

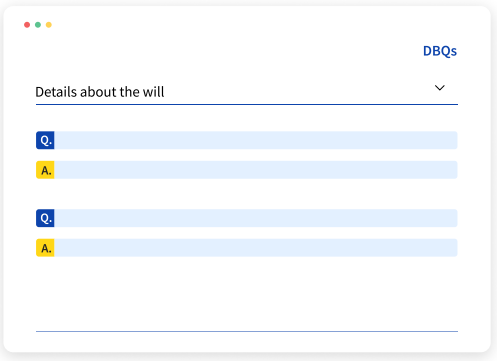

Creating a will is easy with clickawill

A revolutionary online will building app that transforms the traditional estate planning process into a seamless, user-friendly experience.

Simple click get started, enter your details, choose your beneficiaries, and specify how you want your assets to be distributed.

The app will then generate a bespoke will for you.

We believe that estate planning should be accessible to everyone, which is why we’ve designed our platform with the following unique features in mind

DIY Instant Will Creation

At Clickawill, we understand that your time is valuable.

Our platform enables you to draft your will yourself, eliminating the need for lengthy consultations or appointments.

With our intuitive interface, you can create your will instantly, saving both time and effort.

Ensure Your Estate Goes to the Right Hands

With Clickawill, you can rest assured that your estate will pass to the individuals you specify in your will.

By establishing your beneficiaries clearly, you ensure that your hard-earned assets are distributed according to your wishes.

Privacy and Confidentiality Guaranteed

We value your privacy, which is why Clickawill ensures that your estate planning remains confidential.

Unlike traditional methods that may require sharing sensitive information with attorneys or advisors, Clickawill empowers you to maintain complete control over your personal affairs.

In Control with Professional Assistance

Clickawill combines the best of both worlds – DIY convenience with professional expertise.

Our platform provides authentic wording drafted by experienced will and estate planning lawyers, offering you the peace of mind that your will adheres to legal standards.

Modern Estate Planning

With Clickawill, creating a legally-binding will is just a few clicks away, giving you the power to control your estate’s destiny from the comfort of your own home, without the need to disclose your personal information to anyone.

For Whom Clickawill is Ideal

Clickawill is designed to cater to individuals seeking straightforward estate planning with clear beneficiaries.

If you wish to share your entire estate among a select few beneficiaries, our platform is the perfect solution for you.

What Clickawill is Not For

While Clickawill covers a wide range of estate planning needs, there are certain scenarios for which our platform might not be suitable:

When Next of Kin Are Not Beneficiaries

If your intended beneficiaries do not include your next of kin, additional legal advice may be required. Clickawill is not intended to handle complex family arrangements that could lead to conflicts.

When Financial Dependents Are Not Beneficiaries

In situations where financial dependents are not included as beneficiaries, a deeper assessment of your estate plan is recommended. Clickawill aims to simplify estate planning for straightforward cases.

When Beneficiaries Might Face Financial Hardship

If your estate plan could potentially cause financial hardship to certain beneficiaries, it’s important to seek professional advice to ensure fair and equitable distribution of your assets.

Feeling lost? We work closely with professional advisors who can advise you on estate planning matters. Submit an enquiry on our Contact Us page.

The Clickawill Experience

Clickawill empowers you to take charge of your estate planning journey like never before.

With our user-friendly platform, you can create a DIY will instantly and with confidence.

Say goodbye to the complexities of traditional estate planning and embrace the convenience of Clickawill.

Ensure your legacy is safeguarded and your loved ones are provided for, all from the comfort of your home.

Start your Clickawill journey today!

Other Estate Planning Considerations

Asset Allocation

Everyone has possessions they will leave behind when they die. It consists of everything you own: your home, any other piece of real estate, car, furniture, and other personal possessions.

It also includes all your finances, investments, and life insurance. The value of each one may be modest but they all form part of your estate – something you can’t take with you when you die.

Many people think estate planning just means preparing a will, but it covers much more than that. It is, in fact, just as crucial as retirement planning because you want it to last your lifetime and pass along all your assets to your loved ones.

Guardianship

In the event of both parents passing away, a Deed of Guardianship can be used to appoint guardians of the minor children and provide guidelines in relation to the caring and well-being of such minor children.

A Deed of Guardianship must be in writing and dated and signed by the parents making the Deed of Guardianship before two witnesses.

A deed of appointment of temporary guardianship (“DTG”) is a document that ensures that your minor children are protected and taken care of by those you trust during unforeseen circumstances.

Contentious Probate

When complications arise, these often relate to foreign grants, assets in other jurisdictions, the validity of the will or inheritance provision for dependents, shares in the family businesses, tax or domicile issues.

We work closely with professional advisors who can help you trace and report on assets, comply with regulatory requirements in Hong Kong and internationally, and achieve successful estate outcomes.

Cross-border Asset Management

Internationalization of both Asian and non-Asian clients and a cross-jurisdictional spread of family assets means much more complex succession and tax issues.

The focus of estate planning nowadays has shifted to the efficiency of cross-border asset management and alleviating the pain and trouble of the often cumbersome bureaucratic process.